In honor of the 100th celebration of International Women’s Day, Winch Financial CEO Christina Winch, CFP®, a trailblazer in the financial planning field, offers seven key tips for women to take control of their finances.

In honor of the 100th celebration of International Women’s Day, Winch Financial CEO Christina Winch, CFP®, a trailblazer in the financial planning field, offers seven key tips for women to take control of their finances.

According to her, the biggest issues many women face are an unawareness of the resources available to them and a misinterpretation of safety.

“All women should have at least a basic understanding of their money,” she said. “Many women who are married depend on their spouses to manage their money. They have a husband who takes care of them and that makes them feel safe. But, that’s not safe.”

True safety requires understanding and that takes a little work, but the payoffs can be enormous both in monetary gain and confidence.

- Treat yourself to an education. Take a class, read financial literacy books, listen to podcasts. We know you’re busy, but the time you carve out for financial education will pay off in the long run.

- Meet with a trusted financial advisor, preferably one who will have a fiduciary relationship with you. This means your advisor will have a legal responsibility to act in your best interest. Don’t skip the meetings. They provide an invaluable opportunity for you to learn about what’s happening with your money.

- Ask questions. In her 37 years as an advisor, Christina has fielded all kinds of questions from clients and students. She assures everyone that the only stupid question is the one they were afraid to ask. To maximize your appointment time with your advisor, you might want to bring a list of questions to the appointment.

- Talk to your friends about money. It does not have to be a taboo subject. Start an investment club with your friends and combine a little socializing with some real-time education and, hopefully, portfolio growth. Who knows? You might be a natural. In any case it’s a good idea to have conversations with your friends – share tips on good advisors, software and spending habits.

- Teach your children. Talk to them about taxes, interest rates, inflation, and the difference between gross and net pay. Show them how to budget their money and lead by example.

- Set a budget and stick to it. The best way to gain control over your finances is to understand how much you actually need. Track your expenses, and then analyze them carefully. We all splurge every now and then That’s usually fine. The spending you want to get a handle on are the month-to-month expenditures you might not even be aware you’re racking up.

- Start now. Procrastinating only makes the task harder. The good news is that, by reading this post, you’ve already taken the first step toward educating yourself. Just keep moving forward.

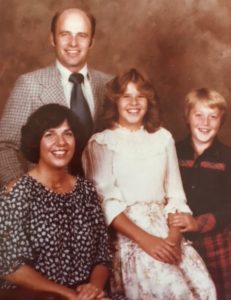

Like many women, Winch Financial CEO Christina Winch, CFP®, wore many hats while she built the business she launched in 1981. She taught, raised her children and took care of her mother. Later, she also had to negotiate the sad waters of widowhood. Today, all three of Christina’s grown children are financial advisors and work with her at Winch Financial.