Health insurance, one of the most important decisions you’ll make regarding your retirement, also can be the most confusing.

Health insurance, one of the most important decisions you’ll make regarding your retirement, also can be the most confusing.

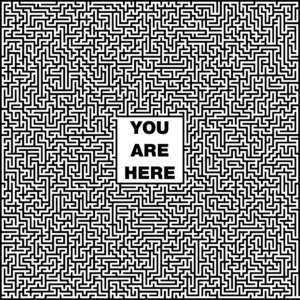

We’re here to help. Our education-focused approach to financial planning means we’ll always take the time to explain our recommendations and to answer any questions you might have.

As Medicare season approaches, our insurance department and our fiduciary advisors stand ready to help you sift through all the information bombarding your newsfeeds, phonelines and postal mailboxes.

Medicare, the federal insurance plan for people 65 and older, younger people with certain disabilities and people suffering from end stage renal disease, requires participants to choose specific coverage plans and make their decisions within one annual window of time.

The program involves three parts:

- Part A covers hospital insurance, including inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery and home health care.

- Part B covers medical insurance, including doctor and other health care providers’ services and outpatient care, durable medical equipment, home health care, and some preventive services.

- Part D covers prescription drugs

- And Part C, or Medicare Advantage, bundles all three to varying degrees.

The annual Medicare Election period for 2020 coverage runs from October 15, 2019, to December 7, 2019, during which time you can make changes to various aspects of your coverage. If you didn’t enroll in a Medicare Part D plan when you were first eligible, you can do so during the general open enrollment, although a late enrollment penalty may apply.

Another enrollment period to keep an eye on is the Medicare Supplement Open Enrollment Period, which is different than the annual fall open enrollment period. This is a once in a lifetime six-month window that begins once your Part B is in effect an allows you to obtain insurance that supplements your federal insurance plan.

The beauty of the Medicare Supplement Open Enrollment Period is that you don’t have to answer any health questions during this time frame, which can affect the cost and scope of coverage your able to obtain outside this period.

As with all decisions affecting your retirement, we recommend doing your homework ahead of time. Research your options and talk through them with your advisor (preferably one who has a fiduciary relationship with you).

If you or anyone you know has questions regarding retirement insurance coverage, call or email us to set up an appointment. We’re always glad to help.